State Tax Refund Worksheet Item B

State Tax Refund Worksheet Item B - Web do i need to complete the state refund worksheet? The state tax refund worksheet is used to determine how much (if any) of your previous year (s). Web what is item b on state tax refund worksheet? Check refund status can only be used for tax returns filed after december 31st, 2007. Web updated on february 13, 2023. If the amount was changed due. Web state and local refund worksheet. Web a state or local income tax refund. State of arizona department of revenue check refund status refund status phone support: Web 14 rows arizona resident personal income tax booklet update to the 2020 increase standard deduction worksheet for taxpayers electing to take the standard. (a) didn’t itemize deductions, or (b) elected to deduct state and local. Web a state or local income tax refund. Web state and local refund worksheet. Web do i need to complete the state refund worksheet? How to know if you. Check refund status can only be used for tax returns filed after december 31st, 2007. This article will help you understand how the state and local refunds taxable. Web a state or local income tax refund. Web where does the amount for item b in the schedule 1 of the state and local income tax refund worksheet come from? Web. Web 1) is the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in 2021 [line 5d of the 2021 schedule a, (form 1040)],. Identify the return you wish to check the refund status for. The program is asking how much you reported as state and local taxes paid on. Web do i need to complete the state refund worksheet? The state tax refund worksheet is used to determine how much (if any) of your previous year (s). Web 14 rows arizona resident personal income tax booklet update to the 2020 increase standard deduction worksheet for taxpayers electing to take the standard. But don’t enter more than the amount of. Web 14 rows arizona resident personal income tax booklet update to the 2020 increase standard deduction worksheet for taxpayers electing to take the standard. Starting with the 2019 tax year, arizona allows a. State of arizona department of revenue check refund status refund status phone support: Web use the qualified dividends and capital gain tax worksheet or the schedule d. The program is asking how much you reported as state and local taxes paid on the previous year return, in your case, on your. Ad save time and money with professional tax planning & preparation services. How to know if you. Web 1) is the amount of state and local income taxes (or general sales taxes), real estate taxes, and. Web do i need to complete the state refund worksheet? Use this worksheet only if the taxpayer itemized. If the refund was changed for a tax issue you would use the amount you received. This error refers to the amount on line 5c of your schedule a, which is state and local personal property taxes. Web use the qualified dividends. Use this worksheet only if the taxpayer itemized. See the instructions for line 16 for. Select the tax year from the drop down. If the refund was changed for a tax issue you would use the amount you received. The program is asking how much you reported as state and local taxes paid on the previous year return, in your. But don’t enter more than the amount of your state and local income taxes shown on your 2017. This worksheet is confusing the amount. Web 14 rows arizona resident personal income tax booklet update to the 2020 increase standard deduction worksheet for taxpayers electing to take the standard. Ad get deals and low prices on turbo tax online at amazon.. We offer a variety of software related to various fields at great prices. Web make sure you indicated that you received a refund (if you did) and what your state tax amount paid was in the section. This worksheet is confusing the amount. This error refers to the amount on line 5c of your schedule a, which is state and. Web may 12, 2021 6:26 am. Web state and local refunds taxable worksheet for form 1040 in proconnect. When is a state refund taxable? Check refund status can only be used for tax returns filed after december 31st, 2007. This worksheet is confusing the amount. Web a state or local income tax refund. Solved•by intuit•42•updated 1 year ago. Starting with the 2019 tax year, arizona allows a. State of arizona department of revenue check refund status refund status phone support: Web make sure you indicated that you received a refund (if you did) and what your state tax amount paid was in the section. Web for tax years prior to 2019, arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. How to know if you. We offer a variety of software related to various fields at great prices. This error refers to the amount on line 5c of your schedule a, which is state and local personal property taxes. Identify the return you wish to check the refund status for. Web what is item b on state tax refund worksheet? The program is asking how much you reported as state and local taxes paid on the previous year return, in your case, on your. The state and local tax deduction. None of your refund is taxable if, in the year you paid the tax, you either: This article will help you understand how the state and local refunds taxable.10 Tax Deduction Worksheet /

Are the instructions for calculating the taxable portion of the state

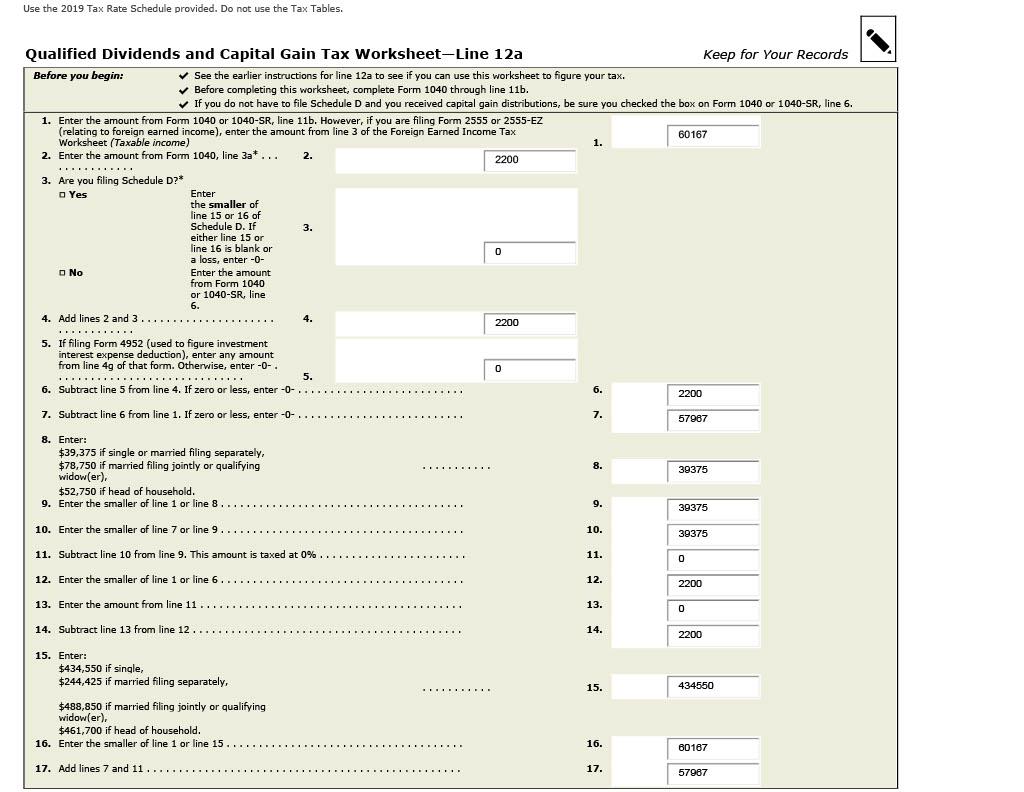

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf Ideas

2014 Form MN DoR M1PR Fill Online, Printable, Fillable, Blank pdfFiller

1040 INSTRUCTIONS

Form 9 9a Tax Table Most Effective Ways To Form 9 9a Tax Table

Form 1040 State And Local Tax Refund Worksheet

2018 Homestead Credit Refund and Property Tax Refund Form M1PR for

Downloadable Irs Form 1040 Form Resume Examples o7Y314M32B

Form N11 State Tax Refund Worksheet 2016 printable pdf download

Related Post:

/1040-NR-EZ-NonresidentAlienswithNoDependents-1-992eb3e7ab6d49b782ad46ab42ae00e5.png)